News

Dangote Lists N300B Series 1 And 2 Largest Bonds On NGX ,FMDQ

News

Ganduje Hints at Reconciling with Kwankwaso

By Yusuf Danjuma Yunusa

Former National Chairman of the All Progressives Congress (APC), Dr. Abdullahi Umar Ganduje, has extended an olive branch to his longtime political rival, Senator Rabiu Kwankwaso.

Speaking in an interview with the BBC Hausa Service on Wednesday, Ganduje expressed a desire to mend fences and reunite for the progress of Kano State.

“I am hopeful that very soon we will reconcile with Kwankwaso so we can move forward together. We have shared a political camp in the past and remain brothers,” Ganduje stated.

Emphasizing a departure from past rivalries, he noted that current political realignments in Kano have ushered in a new era of cooperation focused on governance rather than conflict.

“With the present realignment, the politics of rivalry in Kano may be over. Our priority now is delivering good governance to our people,” Ganduje explained. “If Governor Abba Yusuf succeeds, we all succeed—and if we succeed, he also succeeds. It is vital for all of us to understand this so that the government can thrive.”

Ganduje, drawing from his experience as former APC National Chairman, added that his tenure provided him with deep insight into party operations and conflict resolution mechanisms.

When questioned on whether Governor Abba Yusuf would receive an automatic ticket in future elections, Ganduje acknowledged party conventions while underscoring adherence to established rules.

“I am familiar with the party’s workings. There are rules and there are traditions. The tradition grants a sitting governor the right of first refusal, though this principle does not extend to other positions,” he clarified.

NIGERIAN TRACKER reports that former Governor Abdullahi Umar Ganduje was anointed by his predecessor and long time political associate Senator Rabiu Musa Kwankwaso during the 2015 general elections after which the duo fell out in March 2016 due to some differences that suddenly emerge less than a year into the tenure of Dr Ganduje as Governor of Kano state.

News

JUST IN: Work Resumes at FCTA Following Court Order Suspending Strike

By Yusuf Danjuma Yunusa

Normal operations resumed at the Federal Capital Territory Administration (FCTA) secretariat and its affiliated Ministries, Departments, and Agencies (MDAs) on Wednesday, following a ruling by the National Industrial Court of Nigeria ordering the suspension of an ongoing industrial action.

The court, presided over by Justice E. D. Subilim, on Tuesday directed the immediate suspension of the strike embarked upon by workers under the Joint Union Action Committee (JUAC) to allow for continued dialogue.

In response to the ruling, the Minister of the Federal Capital Territory, Barr. Nyesom Wike, called on all employees to return to their posts promptly. While acknowledging the right to lawful protest in a democracy, the Minister emphasized the importance of respecting judicial directives.

To ensure full compliance, the Acting Head of the Civil Service of the FCT, Mrs. Nancy Sabanti, issued a circular dated January 27, 2026, instructing all Secretariats, Departments, and Agencies to reopen offices and maintain strict staff attendance registers. The circular directed Permanent Secretaries and Heads of Departments, Parastatals, and Agencies to enforce the immediate resumption of duties.

Observations across various FCTA offices and MDAs on Wednesday indicated a substantial level of compliance, with staff present on the premises and engaged in their official responsibilities.

The FCTA administration has reiterated its commitment to constructive dialogue with union representatives and to the continued improvement of staff welfare.

News

Reps Summons Finance, Agriculture Ministers, Auditor-General Over Agricultural Funds

By Yusuf Danjuma Yunusa

The House of Representatives Ad hoc Committee investigating Agricultural Subsidies, Intervention Funds, Aids, and Grants Programmes has summoned the Ministers of Finance and Agriculture and Food Security, as well as the Auditor-General of the Federation, to account for expenditure on agricultural programmes between 2015 and 2025.

The summons was issued during a public hearing held in Abuja on Tuesday, where lawmakers demanded explanations regarding funds released for key agricultural initiatives over the past decade.

The committee directed the officials, or their duly authorized representatives, to appear before it on February 3, warning that failure to comply would result in legislative sanctions in accordance with the powers vested in the National Assembly.

In his ruling, the Chairman of the committee, Rep. Jamo Aminu (APC-Katsina), stated that the investigation aims to ensure transparency and accountability in the use of public funds intended to boost food production, support farmers, and enhance national food security.

“The interventions under review were designed to strengthen our agricultural sector and ensure food security for all Nigerians. However, persistent concerns over food insecurity, rising food prices, and the effectiveness of past programmes have made this scrutiny imperative,” Rep. Aminu said.

The chairman expressed strong dissatisfaction with the Office of the Auditor-General of the Federation for its failure to provide audit reports on several agricultural subsidy and intervention programmes during the specified period.

He emphasized that comprehensive audit documentation is essential for tracking the disbursement, utilization, and outcomes of the funds.

“We cannot effectively conduct this investigation without proper audit records. These funds span a decade and involve critical national programmes. Transparency and accountability in this process are non-negotiable,” he stated.

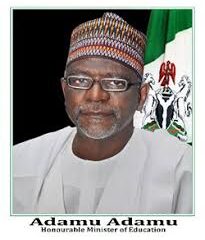

Earlier in the hearing, Mr. Mohammed Adamu, a Deputy Director from the Office of the Auditor-General, attributed the lack of completed audit reports to insufficient cooperation from the Ministry of Agriculture and Food Security.

According to Adamu, the Auditor-General’s office has repeatedly requested necessary documents related to agricultural subsidies, grants, aids, and intervention programmes but has not received the required information from the ministry.

“The primary source of these documents is the Ministry of Agriculture. Without their cooperation, finalizing the audit process has been challenging,” he explained.

The hearing continues as part of the House’s ongoing efforts to enhance oversight and ensure that public funds are used effectively for national development.

-

Opinion4 years ago

Opinion4 years agoOn The Kano Flyovers And Public Perception

-

Features5 years ago

Features5 years agoHow I Became A Multimillionaire In Nigeria – Hadiza Gabon

-

Opinion5 years ago

Opinion5 years agoKano As future Headquarters Of Poverty In Nigeria

-

History5 years ago

History5 years agoSheikh Adam Abdullahi Al-Ilory (1917-1992):Nigeria’s Islamic Scholar Who Wrote Over 100 Books And Journals

-

Opinion4 years ago

Opinion4 years agoMy First Encounter with Nasiru Gawuna, the Humble Deputy Governor

-

History5 years ago

History5 years agoThe Origin Of “Mammy Market” In Army Barracks (Mammy Ochefu)

-

History4 years ago

History4 years agoThe History Of Borno State Governor Professor Babagana Umara Zulum

-

News4 years ago

News4 years agoFederal University Of Technology Babura To Commence Academic Activities September